#Factory Construction Service Companies in Erode

Explore tagged Tumblr posts

Text

#warehouse construction in Erode#Top Warehouse Contractors in Erode#top warehouse construction company in Erode#Small warehouse construction companies in Erode#warehouse building construction companies in Erode#factory construction contractors in Erode#Top Factory Contractors in Erode#factory builders in Erode#Factory Shed Construction in Erode#factory constructors company in Erode#Top Building Contractors For Factory Shed in Erode#Factory Construction Service Companies in Erode

0 notes

Text

Best Earth Movers Near Me in Coimbatore – NKT Earth Movers

When you're searching for Earth movers near me, it's crucial to choose a company with a solid reputation, quality machinery, and competitive pricing. NKT Earth Movers, operating in Coimbatore for over 11 years, is one of the leading providers of high-performance earthmoving equipment and excavation services in Tamil Nadu.

From large-scale commercial projects to small residential jobs, NKT Earth Movers offers everything you need in earthmoving equipment. Our services are reliable, affordable, and trusted by contractors, builders, and developers across Coimbatore.

🏗️ Who We Are – NKT Earth Movers

NKT Earth Movers is a Coimbatore-based company specializing in heavy equipment rental and excavation services. We’ve been serving the region for over a decade, offering reliable and prompt solutions for:

Land excavation

Site leveling

Debris removal

Road construction

Foundation digging

Pipeline trenching

We’re known for our top-quality machines, prompt service, skilled operators, and commitment to customer satisfaction.

🚜 Our Earthmoving Equipment

At NKT, we house a fleet of well-maintained and latest-model machinery, including:

JCB Excavators

Backhoe Loaders

Hydraulic Earth Movers

Bulldozers

Wheel Loaders

Tippers & Dumpers

Each machine undergoes regular maintenance to ensure maximum performance and safety on-site.

💰 Affordable Earth Movers in Coimbatore

What sets NKT apart is our cost-effective pricing. Our hourly and project-based rental charges are among the most competitive in the region, starting from ₹700 per hour, making us the most affordable earth movers in Coimbatore.

🔍 Why Choose NKT Earth Movers?

✅ Over 11 Years of Industry Experience ✅ Transparent Pricing – No Hidden Charges ✅ Skilled Operators with Safety Training ✅ Fast On-Time Deployment ✅ Flexible Rentals – Hourly, Daily, or Project-Based ✅ 24/7 Support for Emergency Services

Whether you need a single machine for a few hours or an entire fleet for weeks, we offer custom solutions to match your project’s needs and budget.

📍 Areas We Serve

We provide services throughout Coimbatore and nearby regions, including:

Peelamedu

Gandhipuram

Singanallur

Sulur

Saravanampatti

Avinashi Road

Pollachi

Mettupalayam

Just search "earth movers near me", and NKT will be the top choice in your location.

🧰 Earthmoving Services We Offer

Our expertise covers a wide range of tasks such as:

Residential Excavation: Foundations, swimming pools, garden landscaping

Commercial Projects: Building sites, factories, industrial land development

Road and Highway Work: Land clearing, base preparation, debris removal

Agricultural Projects: Farm leveling, canal digging, borewell pits

Demolition & Debris Handling: Site clearance and transportation

👷 Skilled Team & Timely Execution

All our operators are professionally trained and certified. Our team works closely with your project manager or architect to ensure tasks are completed safely, correctly, and on time.

We understand the importance of deadlines in construction and promise zero delay deployment across Coimbatore.

📞 Book Your Earth Movers Today

Booking with NKT is simple:

Call us at [Your Phone Number]

Get a free site assessment & quote

Confirm rental schedule

Get machines delivered on-time

🙋 Frequently Asked Questions (FAQs)

Q1. What is the cost of hiring an earth mover in Coimbatore? Charges start from ₹700 per hour, depending on the type of machinery and project duration.

Q2. Do you provide operators with the machines? Yes. All our machines come with professional operators included in the rental.

Q3. Can I rent machines for just a day? Absolutely! We offer flexible hourly, daily, and long-term rentals.

Q4. Are your services available outside Coimbatore? Yes. We also serve nearby towns like Pollachi, Tiruppur, and Erode on request.

Q5. How do I know which machine I need? Our team will assist you based on the site visit or your project requirement.

🏁 Conclusion

If you're looking for trusted earth movers in Coimbatore, NKT Earth Movers is your go-to partner. With 11+ years of excellence, skilled manpower, and affordable pricing, we bring value, speed, and performance to every construction site.

Call us today to schedule your equipment rental and experience the best service in town!

0 notes

Text

Compliance Audit Services in NCR: Safeguarding Your Business from Regulatory Risks

The National Capital Region (NCR) of India—which includes Delhi, Gurugram, Noida, Faridabad, and Ghaziabad—serves as the corporate backbone of North India. With a wide range of industries operating here, from IT and manufacturing to retail and real estate, regulatory compliance has become a critical concern. In this complex and evolving environment, Compliance Audit Services are not just a safeguard against legal risk—they are a strategic necessity for sustainable growth.

✅ What is a Compliance Audit?

A Compliance Audit is a systematic review of an organization’s adherence to statutory and regulatory requirements under various applicable laws. These audits evaluate whether internal processes align with the legal obligations concerning:

Labour laws (EPF, ESIC, CLRA, etc.)

Factories Act & Shops and Establishments Act

Environmental regulations

Industrial safety standards

Contract labour and third-party vendor compliance

Payroll and statutory deductions

Record and register maintenance

📍 Why NCR-Based Corporates Must Prioritize Compliance Audits

1. Multiple Jurisdictions, Diverse Laws

NCR spans multiple states—Delhi, Haryana, and Uttar Pradesh—each with its own labour laws, rules, and enforcement bodies. Businesses operating in more than one NCR city must comply with all applicable state-specific regulations.

2. Increased Regulatory Vigilance

With growing focus on employee rights, workplace safety, and ESG practices, labour departments across NCR have become more stringent. Regular audits help avoid sudden inspections, penalties, and legal actions.

3. Third-Party & Vendor Compliance Risk

In today's outsourcing-driven environment, any non-compliance by a contractor or service provider can implicate the principal employer. Compliance audits help identify and rectify such vulnerabilities.

4. Support for Mergers, Acquisitions, & IPOs

Due diligence and legal scrutiny during funding rounds or acquisitions often include detailed compliance audits. Early preparedness builds investor confidence and reduces last-minute surprises.

5. Reputation & Employee Trust

Non-compliance with wage laws, benefits, or safety norms can damage brand reputation and erode employee trust. Proactive audits help demonstrate ethical business practices.

🧾 Scope of Compliance Audit Services

Professional compliance audit services in NCR typically include:

Audit of statutory records & registers

Verification of payroll compliance (EPF, ESIC, PT, LWF, TDS)

Evaluation of contractor/vendor compliances

Review of licenses, renewals, and returns filing status

Assessment of working conditions, employee benefits, and statutory policies

Gap analysis and risk scoring

Actionable audit reports and compliance roadmaps

Support during labour inspections or notice replies

🛠️ How the Process Works

Pre-Audit Consultation – Understanding the scope, nature of business, and applicable laws

On-Site/Off-Site Document Review – Scrutinizing registers, challans, returns, and licenses

Interviews and Field Observations – Assessing on-ground compliance with labour welfare and safety standards

Gap Analysis Report – Highlighting non-compliances, risk areas, and corrective steps

Remediation Assistance – Guidance or execution support for resolving audit findings

📊 Key Benefits of Compliance Audit Services

Avoid penalties, litigation, and business disruption

Strengthen internal controls and documentation

Ensure alignment with the latest regulatory updates

Boost credibility among employees, investors, and regulators

Build readiness for inspections and audits by government bodies

🏢 Ideal for Businesses In:

IT & ITeS companies

Manufacturing and logistics firms

Construction and infrastructure projects

Startups scaling operations across NCR

Companies employing contract/outsourced manpower

📝 Conclusion:

With the regulatory environment becoming increasingly strict and complex, especially in a diverse zone like NCR, Compliance Audit Services are no longer optional—they are critical for legal protection, risk mitigation, and business continuity. Periodic audits ensure that your company stays ahead of compliance requirements, avoids last-minute surprises, and builds a strong, trustworthy foundation for growth.

Need Expert Compliance Audit Support in Delhi-NCR? Our team of compliance professionals offers detailed audit, gap analysis, and remediation services tailored to your industry and operating states. Stay compliant, stay confident.

0 notes

Photo

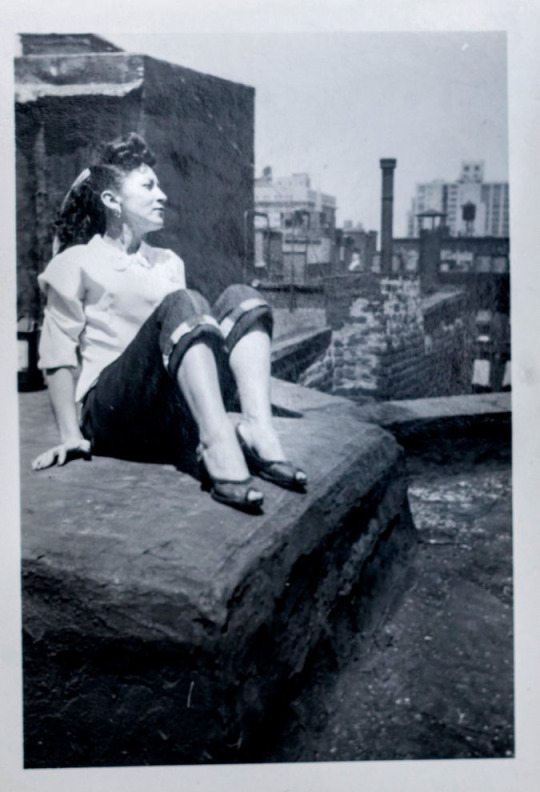

When Neri Carranza went to see the apartment on West 109th Street in Manhattan, she folded money into the pocket of her blue jacket, just in case she liked the place. This would be the first apartment she had ever looked at, the first time she could make a home of her own, paid for with the earnings from her first job, at a glass factory. And the apartment was exactly as her friend from church had described it: small but comfortable.

So on a freezing Sunday in 1956, Ms. Carranza, then 32, with a crown of black hair and a fierce desire for independence, moved into the narrow two-bedroom apartment. She made it her own, cleaning and decorating every Sunday, planting yellow roses and hot-pink geraniums in window boxes, painting the walls white when they needed a new coat. As landlords came and went, Ms. Carranza stayed, becoming a fixture in the largely Latino neighborhood.

“I had everything I ever wanted,” Ms. Carranza said.

(Ms. Carranza in the 1950s. She became a fixture in her neighborhood, staying in her small two-bedroom apartment as landlords came and went. Then the Orbach Group snapped up her building and 21 others nearby.)

But one day in 2010, when she was 87, Ms. Carranza learned that her new landlord wanted to evict her for what seemed like the most nonsensical reason: She supposedly didn’t live in her own beloved home.

She was hardly the only tenant facing eviction by the owners, the Orbach Group, a New Jersey-based company that had recently paid about $76 million for her building and 21 others nearby, a Monopoly move that effectively snapped up most of the residential real estate along a block of West 109th Street. Orbach had filed eviction suits in housing court against scores of her neighbors in rent-regulated apartments.

What happened to Ms. Carranza and the others shows how New York City’s housing court system, created in part to shelter tenants from dangerous conditions, has instead become a tool for landlords to push them out and wrest a most precious civic commodity — affordable housing — out of regulation and into the free market.

Rent-regulated apartments, often the only homes in New York that people of modest means can afford, are vanishing as gentrification surges inexorably through the city’s neighborhoods. Mayor Bill de Blasio, now in his second term, has staked much of his legacy on alleviating this crisis of disappearing affordable housing and rising homelessness.

Yet the city’s efforts to create new affordable housing are locked in a duel with a countervailing force: powerful incentives for landlords to do everything possible to take existing affordable apartments away.

It’s not just that the city’s booming population and economy have spawned a wildly lucrative free market. The entire structure of tenant protections — while probably still the nation’s strongest, at least on paper — has been steadily eroded by landlord-friendly laws adopted in Albany and haphazard regulation.

Landlords, especially the corporate owners who control an increasing share of the market, follow a standard playbook to push tenants out. That is often the first step toward raising the rent enough — beyond $2,733.75 a month, under current rules — to break the shackles of regulation. Owners may offer tenants buyouts to leave. They may harass them with poor services and constant construction. And, sometimes on the flimsiest of evidence, they may sue them in housing court.

It is impossible to say how many evictions are unjust. Many people sued for eviction do owe some back rent, and some tenants certainly abuse the court system, remaining in their apartments for months without paying. For small landlords, such tenants can mean fiscal ruin.

But an investigation by The New York Times illustrates how the Orbach Group and other mega-landlords exploit a broken and overburdened system. In one of the busiest courts in the nation, errors often go uncaught and dubious allegations go unquestioned. Lawsuits are easy to file but onerous to fight. Landlords have lawyers. Tenants usually don’t, despite a new law that aims to provide free counsel to low-income New Yorkers.

(Continue Reading)

#politics#the left#new york times#new york city#housing#housing market#affordable housing#public housing#social housing

117 notes

·

View notes

Text

Impact of COVID-19 on Metal and Mining in the Chemical and Materials Industry

COVID-19 Impact on Metal and Mining in the Chemical and Materials Industry

INTRODUCTION

Metal and mining industry is one of those industries that have been severely impacted due to the outbreak of coronavirus globally. The prices of steel and other metals have shown different behavior due to demand and supply scenario change. In response to the spread of the virus, some governments have seized the borders and have imposed large scales quarantines and social distancing measures to minimize the spread of the virus any further. The safety and well-being of workers were rightly the top priority of any country, but now companies must consider the economic effects of the pandemic, which are now apparent.

To keep the well-being of employees in concern, companies have taken drastic measures such as asking non-operational staff to work from home to scaling back production; even many of the companies have reduced their operations and manufacturing capacities to get less impacted with the global pandemic. Such steps have resulted in reduced productivity and profits of many industries, including metals and mining precipitously. To come back on track, the companies need to make strategic choices for building their cost resilience to prepare themselves for the recovery, as well as even rethink on their new operating models

Some of the views presented by associations and company professionals are:

· “Companies are facing restrictions in logistics and transport, trades have been muted, prices of raw materials and steel have slid, which is causing the market’s value to decline”, by China Iron & Steel Association

· “ We believe the effect of the coronavirus will likely have a short-term negative demand impact in China and to a lesser degree elsewhere,” by ArcelorMittal

· “We reviewed the situation arising in China due to the virus outbreak in the initial weeks. While we do not depend on China as a market for steel, we do source some of our consumable items from it. We are thus trying alternative supply sources in countries like Turkey and Brazil,” by TV Narendran, chief executive, Tata Steel.

IMPACT OF METAL AND MINING INDUSTRY

The outbreak of coronavirus started showing its impact mainly from March of 2020. The average share pricing of metal and mining industry dropped by almost 10% and many standalone companies have lost around 40-50% of their market value. The effect of COVID-19 has changed from moderate in March 2020 to high in April 2020 and is still aggressively increasing. Some of the major players in the mining market such as BHP Billiton, Rio Tinto, and Anglo American have so far reported partial shutdowns and due to this, the industry has almost reported a production loss of more than 30% till now.

It has been observed that the price of various commodities such as iron ore, copper, coal and zinc, fell by >5% due to lower-near term demand. The only exception to this trend is gold.

The above mentioned chart clearly states that as compared to last year (2019), the prices of almost all commodities have declined, except a few which have geared up recently.

China accounts for more than 20% share in the global supply chain of intermediate products which includes metal and metal products. Thus, the disruption which has been caused due to COVID-19 in China only is expected to repeat on the economy in various countries worldwide. It is expected that the metal industry of European Union will lose over USD 1 thousand million if China exports reduced by even 2%. The steel manufacturer in Europe are cutting production and idling factory lines in which the workers are not working as because of declining orders, a lack of available staff or as a safety precaution against coronavirus. As per the commodity consultant, James Campbell at CRU, “This is going to be a loss making year for the European steel industry.”

Due to the downfall in the metal and mineral industry, the other industries that are dependent on supply of ferroalloys and steel, such as automobiles, foundries, have been shutting down across global. As per some of the experts, it is not because of coronavirus spread that metal industry is facing dip in the demand; rather it is the quarantine or the shutdown that is eroding the demand. Ideally there are two aspects of looking into the problem of demand:

1. The quarantine

2. Economic crash on a medium-term horizon

Along with this, various countries are keeping track of Chinese activities that they did to bring back the industry on track. The Chinese steel consumption from January 2020 to February 2020 increased by almost 5.5%. The production in China grew by 3.1% in March and April. Also, the investment in the fixed assets has increased by 24.5% and the investment in the infrastructure has increased by 30.3%, which is even higher than the decline during the crises of 2008-2009.

IMPACT ON IRON ORE

The spread of coronavirus has impacted iron ore production and its pricing too. Though compared to 2019, there has been an increase of 0.5% in the pricing but it has faced a dip that no one has expected. The price in 2019 was USD 90.4/tons, and till March in 2020, it averages $83.5/tons. In terms of production, it is expected that iron ore may show a growth of 0.8% in 2020, as compared to 4.7% growth in 2019. The slow growth is due to government lockdowns around the global disruption in operations. The supply chain has also disrupted as many mines are forced to shut their operation in Canada, South Africa, Peru, and India. Till March 2020, the steel production in China is averaged 3.6% as compared to 7.7% in 2019. As China is also facing the logistic issue, which temporarily has increased China’s demand for seaborne iron ore post-April 2020.

IMPACT ON COAL

Coal is another commodity or metal that has faced the impact of COVID-19 harshly. The demand for coal is facing slowdown from past one decade due to competition from cheap natural gas and other expanded renewable energy sources. As the world is moving away from fossil fuels, the coal industry is in desperate need to revive. Along with this, the pandemic has added a big reason to its downfall and has made the situation worse. Most of the companies in Pennsylvania, Illinois and Virginia have temporarily suspended their operations to control the spread of virus.

By January, before the pandemic out broke in the U.S., the drop in coal production was forecasted to 14% in 2020. But as the coronavirus speeded in the country and the mild winter which requires less electricity at heat homes, the downfall is now expected to be more than 25% by the end of this year.

In April 2020, the coal exports from Indonesia hit lowest level since June 2009 due to the spread of coronavirus crises. Exports from Indonesia averaged around 32 MT during April 2015-2019 which dropped to almost 18 MT in April 2020. On the other end, import of coal has also suffered in many countries.

For instance,

· India’s coal import in March 2020 was at 15.74 million tons which were low by 27.5% as compared to import in March 2019. Though from April 2019 to March 2020, the total coal and coke imports stood at 242.97 MT (provisional), which is 3.24% higher than from April 2018 to March 2019, the major low will be reflected in the statistics of 2020 fiscal year. As per Vinaya Varma, managing director and chief executive of mjunction services, “The lockdown imposed across the countries due to novel coronavirus pandemic has had a cascading effect on this sector. There was a significant drop in India’s coal import volumes due to both demand and supply-side factors, i.e. offtake, consumption, logistics, and dispatches.” Moreover, as per the statement by Coal Minister Pralhad Joshi, to stop the substitutable import of coal in the next three to four years may further present a dip in the coal industry.

IMPACT ON STEEL

The steel industry has faced multiple hits this year due to reduced demand from its major consumers, automotive and construction, and infrastructure. Automotive accounts for around 15-20%. In the year 2020, steel production has declined gradually due to the outbreak of coronavirus. Steel industries in countries like India depend on China for various consumables include manganese, refractory products, and compounds, electrodes, and rolls for steel mills. Thus, any impact on the Chinese industry will have direct implications on all the countries that are dependent on China. Due to overdependence on imports, the price of raw materials shoots up by multiple folds and thus making the end product costlier. One of the biggest steelmaking companies, Tata Steel, has recently decided to reduce its dependence on China for the supply of steel making inputs. Along with Tata Steel, many other companies are trying to shift their supplies from China to other countries like Turkey and Brazil. This is one of the steps suggested by the government in discussion with the steel manufacturing companies to de-risk the supply chain.

As the demand for steel has gone down tremendously, government of various countries has forced the manufacturers to cut the production to almost 50% of the capacity. Along with this, the lockdown and movement restrictions have also impacted the timely delivery and dispatches of the finished goods. In countries like India, where almost 80-85% of trucks are not moving worsens the situation. Thus, officials are requesting government to allow movement of trucks for the industry as they are the major part of any industry.

As per the stats provided by Indian Steel Association (ISA), steel demand in India will face a contraction of 7.7% in 2020. ISA has estimated that in February 2020, the steel demand would grow by 5.1% and will reach 106.7 million tons. But after analyzing the impact and situation that is created due to COVID-19, the estimation has been revised to 93.7 million tons. The lockdown will impact the steel demand by nearly 13 million tons, as per Arnab Kumar Hazra, assistant secretary-general at the Indian Steel Association.

IMPACT ON OTHER COMMODITIES

COPPER: Since the beginning of 2020, copper prices have dropped by almost 15% due to a downfall in demand from various end-use industries. However, with most manufacturers/smelters in china and as the country is slowly getting rid of the pandemic, copper demand and prices are expected to bounce back.

ZINC: Through the prices zinc rose rapidly from 2015 to 2019 will almost an increase of 32%, now facing downfall of around 18% from 2019 to 2020.

NICKEL: Despite of economic downturn, the performance of nickel was better than other commodities. The prices are also showing positive signs along with the supply. It is expected that by the end of 2020, there will be around 3% rise in the demand of nickel.

POSSIBLE STEPS TO BRING METAL AND MINING INDUSTRY BACK ON TRACK

To manage this global crisis, mining and metal leaders are working mainly on three aspects: Respond, Recover and Thrive. Some of the important immediate steps that are advised to metal and mining leaders include:

· Maintain critical services by every possible way while keeping the safety of employees as the top most priority.

· Focus should be more on understanding the financial situation and accordingly release the cash maintain financial viability even through uncertainty.

· Rethink on strategies of work done, and improve the ability to collaborate by using automation and digitization.

Also to lift up the metal and mining industry, the role played by procurement leaders is also vital. There are responsible to mitigate supply-chain risks, covering and protecting cash with enhancement in the overall productivity by making strategic choices. The Chief Procurement Officers (CPOs) should work closely with the operational team and market players so that a strategic move can be taken towards the spending as in what can be stopped, which can be stalled, what can be shrunk and what must be sustained. A control-tower methodology has been suggested to monitor and challenge all of the company’s spending.

One of the major challenges that have appeared in front of almost every industry is over dependency on one or two suppliers. This is of utmost importance that manufacturers should mitigate their risk and lower their losses by increasing number of raw material suppliers so in case pandemic or crises, the operations will not get hit to this extent and situation can be controlled before it gets worsen.

CONCLUSION

The spread of COVID-19 pandemic around the globe has an immediate impact on the global economy and almost on all the industries including metal and mining. In the crises, some of the new players might get more affected than others because of the initial challenges that a business faces and then the challenges brought in by the pandemic. But, for a positive aspect, due to this pandemic, a real sense of togetherness has emerged among the players of the industry to stop the spread of this virus.

The spread of coronavirus has taught many of the players in the market how to better manage their business and always be ready for such situations too. In the mining industry, the impact has varied from commodity to commodity.

For instance,

· Where gold is experiencing high price along with thermal coal and uranium, iron ore is feeling pressure to sustain as it is more dependent as consumer demand.

So, the steps to bring back the economy should be based on commodity rather than entire industry. Also the slowdown has resulted in some new opportunities and has opened doors for new ways of doing business. Since, the metal and mining are working on the same old patterns without much exploring in the ways of doing business. Now, the manufacturers and suppliers are exploring other methods such as atominization, digitization and remote controlled operations. Not only the manufacturers, but also the consumers are welcoming the online delivery of their products and have resulted in reducing human efforts.

Slowly and gradually things are coming back on track. But within few years, by the mutual efforts of the government and manufacturers, the impact can be controlled to an extent. The goal for the players remains same which is to deliver the maximum customer productivity with minimum downtime and maintenance. The impact cannot be eradicated quickly, but will prepare people to say with it with no much impact on their lives.

#Metal and Mining#Metal and Mining Market#Metal and Mining Market Analysis#Metal and Mining Market Analysis in Developed Countries#Metal and Mining Market Forcast#Metal and Mining Market Future Innovation

0 notes

Link

For Clean Energy, Buy American or Buy It Quick and Cheap? Patricia Fahy, a New York State legislator, celebrated when a new development project for the Port of Albany — the country’s first assembly plant dedicated to building offshore wind towers — was approved in January. “I was doing cartwheels,” said Ms. Fahy, who represents the area. Before long, however, she was caught in a political bind. A powerful union informed her that most of the equipment for New York’s big investment in offshore windmills would not be built by American workers but would come from abroad. Yet when Ms. Fahy proposed legislation to press developers to use locally made parts, she met opposition from environmentalists and wind industry officials. “They were like, ‘Oh, God, don’t cause us any problems,’” she recalled. Since President Biden’s election, Democratic politicians have extolled the win-win allure of the transition from fossil fuels, saying it can help avert a looming climate crisis while putting millions to work. “For too long we’ve failed to use the most important word when it comes to meeting the climate crisis: jobs, jobs, jobs,” Mr. Biden said in an address to Congress last month. Interior Secretary Deb Haaland, in announcing the final approval of the nation’s first large-scale offshore wind project on Tuesday, called it an important step to “create good-paying union jobs while combating climate change.” But there is a tension between the goals of industrial workers and those of environmentalists — groups that Democrats count as politically crucial. The greater the emphasis on domestic manufacturing, the more expensive renewable energy will be, at least initially, and the longer it could take to meet renewable-energy targets. That tension could become apparent as the White House fleshes out its climate agenda. “It’s a classic trade-off,” said Anne Reynolds, who heads the Alliance for Clean Energy New York, a coalition of environmental and industry groups. “It would be better if we manufactured more solar panels in the U.S. But other countries invested public money for a decade. That’s why it’s cheaper to build them there.” There is some data to support the contention that climate goals can create jobs. The consulting firm Wood Mackenzie expects tens of thousands of new jobs per year later this decade just in offshore wind, an industry that barely exists in the United States today. And labor unions — even those whose members are most threatened by the shift to green energy, like mineworkers — increasingly accept this logic. In recent years, many unions have joined forces with supporters of renewable energy to create groups with names like the BlueGreen Alliance that press for ambitious jobs and climate legislation, in the vein of the $2.3 trillion proposal that Mr. Biden is calling the American Jobs Plan. But much of the supply chain for renewable energy and other clean technologies is in fact abroad. Nearly 70 percent of the value of a typical solar panel assembled in the United States accrues to firms in China or Chinese firms operating across Southeast Asia, according to a recent report by the Center for Strategic and International Studies and BloombergNEF, an energy research group. Batteries for electric vehicles, their most valuable component, follow a similar pattern, the report found. And there is virtually no domestic supply chain specifically for offshore wind, an industry that Mr. Biden hopes to see grow from roughly a half-dozen turbines in the water today to thousands over the next decade. That supply chain is largely in Europe. Many proponents of a greener economy say that importing equipment is not a problem but a benefit — and that insisting on domestic production could raise the price of renewable energy and slow the transition from fossil fuels. “It is valuable to have flexible global supply chains that let us move fast,” said Craig Cornelius, who once managed the Energy Department’s solar program and is now chief executive of Clearway Energy Group, which develops solar and wind projects. Those emphasizing speed over sourcing argue that most of the jobs in renewable energy will be in the construction of solar and wind plants, not making equipment, because the manufacturing is increasingly automated. But labor groups worry that construction and installation jobs will be low paying and temporary. They say only manufacturing has traditionally offered higher pay and benefits and can sustain a work force for years. Partisans of manufacturing also point out that it often leads to jobs in new industries. Researchers have shown that the migration of consumer electronics to Asia in the 1960s and ’70s helped those countries become hubs for future technologies, like advanced batteries. As a result, labor leaders are pressing the administration to attach strict conditions to the subsidies it provides for green equipment. “We’re going to be demanding that the domestic content on this stuff has to be really high,” said Thomas M. Conway, the president of the United Steelworkers union and a close Biden ally. The experience of New York reveals how delicate these debates can be once specific jobs and projects are at stake. Late last year, the Communications Workers of America began considering ways to revive employment at a General Electric factory that the union represents in Schenectady, N.Y., near Albany. The factory has shed thousands of employees in recent decades. Around the same time, the state was close to approving bids for two major offshore wind projects. The eventual winner, a Norwegian developer, Equinor, promised to help bring a wind-tower assembly plant to New York and upgrade a port in Brooklyn. “All of a sudden I focus on the fact that we’re talking about wind manufacturing,” said Bob Master, the communications workers official who contacted Ms. Fahy, the state legislator. “G.E. makes turbines — there could be a New York supply chain. Let’s give it a try.” In early February, the union produced a draft of a bill that would ask developers like Equinor to buy their wind equipment from manufacturers in New York State “to the maximum extent feasible” — not just towers but other components, like blades and nacelles, which house the mechanical guts of a turbine. Ms. Fahy, a member of the Assembly, and State Senator Neil Breslin, a fellow Democrat from the Albany area, signed on as sponsors. Environmentalists and industry officials quickly raised concerns that the measure could discourage developers from coming to the state. “So far, Equinor has gone above and beyond what any other company has done,” said Lisa Dix, who led the Sierra Club’s campaign for renewable energy in New York until recently. “Why do we need more onerous requirements on companies given what we got?” Ms. Dix and other clean-energy advocates had worked with labor unions to persuade the state that construction jobs in offshore wind should offer union-scale wages and representation. And New York’s system for evaluating clean-energy bids already awarded points to developers that promised local economic benefits. Ms. Reynolds, the head of the environmental and industry coalition in New York, worried that going beyond the existing arrangement could make the cost of renewable energy unsustainable. “If it became bigger and more noticeable on electric bills, the common expectation is that political support for New York’s clean-energy programs would erode,” she said. The communications workers sought to offer reassurance, not entirely successfully. “I said to them, ‘We’re trade unionists: We ask for everything, the boss offers us nothing, and then we make a deal,’” Mr. Master said. “‘But I do think there’s no reason why turbines should be coming from France as opposed to Schenectady.’” The final language, a compromise negotiated with the state’s building trades council and passed by the Legislature in April, allows the state to award additional points in the bidding process to developers that pledge to create manufacturing jobs in the state, a slight refinement of the current approach. (It also effectively requires that workers who build, operate or maintain wind and solar plants either receive union-scale wages or can benefit from union representation.) While the law included a “buy American” provision for iron and steel, the state’s energy research and development agency, known as NYSERDA, can waive the requirement. The agency’s chief executive, Doreen Harris, said she was generally pleased that the existing approach remained intact and predicted that the state would have blade and nacelle factories within a few years. Some analysts agreed, arguing that most offshore wind equipment is so bulky — often hundreds of feet long — that it becomes impractical to ship across the Atlantic. “There’s a point at which importation of all goods and services doesn’t make economic sense,” said Jeff Tingley, an expert on the offshore wind supply chain at the consulting firm Xodus. But that has not always reflected the experience of the United Kingdom, which had installed more offshore wind turbines than any other country by the start of this year but had manufactured only a small portion of the equipment. “Even with the U.K. being the biggest market, the logistics costs weren’t big enough to justify new factories,” said Alun Roberts, an expert on offshore wind with the British-based consulting firm BVG Associates. A 2017 report indicated that the country manufactured well below 30 percent of its offshore wind equipment, and Mr. Roberts said the percentage had probably increased slightly since then. The country currently manufactures blades but no nacelles. All of which leaves the Biden administration with a difficult choice: If it genuinely wants to shift manufacturing to the United States, doing so could require some aggressive prodding. A senior White House official said the administration was exploring ways of requiring that a portion of wind and solar equipment be American-made when federal money was involved. But some current and former Democratic economic officials are skeptical of the idea, as are clean-energy advocates. “I worry about local content requirements for offshore wind from the federal government right now,” said Kathleen Theoharides, the Massachusetts secretary of energy and environmental affairs. “I don’t think adding anything that could potentially raise the cost of clean energy to the ratepayer is necessarily the right strategy.” Mr. Master said the recent legislation in New York was a victory given the difficulty of enacting stronger domestic content policies at the state level, but acknowledged that it fell short of his union’s goals. Both he and Ms. Fahy vowed to keep pressing to bring more offshore wind manufacturing jobs to New York. “I could be the queen of lost causes, but we want to get some energy around this,” Ms. Fahy said. “We need this here. I’m not just saying New York. This is a national conversation.” Source link Orbem News #American #buy #cheap #clean #Energy #Quick

0 notes

Link

A brief introduction to what we at libcom.org mean when we refer to the state and how we think we should relate to it as workers.

This article in: Español | Français | Türkçe | Nederlands

States come in many shapes and sizes. Democracies and dictatorships, those that provide lots of social welfare, those that provide none at all, some that allow for a lot of individual freedom and others that don't.

But these categories are not set in stone. Democracies and dictatorships rise and fall, welfare systems are set up and taken apart while civil liberties can be expanded or eroded.

However, all states share key features, which essentially define them.

What is the state?

All states have the same basic functions in that they are an organisation of all the lawmaking and law enforcing institutions within a specific territory. And, most importantly, it is an organisation controlled and run by a small minority of people.

So sometimes, a state will consist of a parliament with elected politicians, a separate court system and a police force and military to enforce their decisions. At other times, all these functions are rolled into each other, like in military dictatorships for example.

But the ability within a given area to make political and legal decisions – and to enforce them, with violence if necessary – is the basic characteristic of all states. Crucially, the state claims a monopoly on the legitimate use of violence, within its territory and without. As such, the state is above the people it governs and all those within its territory are subject to it.

The state and capitalism

In a capitalist society, the success or failure of a state depends unsurprisingly on the success of capitalism within it.

Essentially, this means that within its territory profits are made so the economy can expand. The government can then take its share in taxation to fund its activities.

If businesses in a country are making healthy profits, investment will flow into profitable industries, companies will hire workers to turn their investment into more money. They and their workers will pay taxes on this money which keep the state running.

But if profits dip, investment will flow elsewhere to regions where profits will be higher. Companies will shut down, workers will be laid off, tax revenues will fall and local economies collapse.

So promoting profit and the growth of the economy is the key task of any state in capitalist society - including state capitalist economies which claim to be "socialist", like China or Cuba. Read our introduction to capitalism here.

The economy

As promoting the economy is a key task of the state, let's look at the fundamental building blocks of a healthy capitalist economy.

Workers

The primary need of a sound capitalist economy is the existence of a group of people able to work, to turn capitalists' money into more money: a working class. This requires the majority of the population to have been dispossessed from the land and means of survival, so that the only way they can survive is by selling their ability to work to those who can buy it.

This dispossession has taken place over the past few hundred years across the world. In the early days of capitalism, factory owners had a major problem in getting peasants, who could produce enough to live from the land, to go and work in the factories. To solve this, the state violently forced the peasants off common land, passed laws forbidding vagrancy and forced them to work in factories under threat of execution.

Today, this has already happened to the vast majority of people around the world. However, in some places in the so-called "developing" world, the state still plays this role of displacing people to open new markets for investors. Read our introduction to class here.

Property

A second fundamental requirement is the concept of private property. While many had to be dispossessed to create a working class, the ownership of land, buildings and factories by a small minority of the population could only be maintained by a body of organised violence - a state. This is rarely mentioned by capitalism's advocates today, however in its early days it was openly acknowledged. As the liberal political economist Adam Smith wrote:

Laws and government may be considered in this and indeed in every case as a combination of the rich to oppress the poor, and preserve to themselves the inequality of the goods which would otherwise be soon destroyed by the attacks of the poor, who if not hindered by the government would soon reduce the others to an equality with themselves by open violence.

This continues today, as laws deal primarily with protecting property rather than people. For example, it is not illegal for speculators to sit on food supplies, creating scarcity so prices go up while people starve to death, but it is illegal for starving people to steal food.

What does the state do?

Different states perform many different tasks, from providing free school meals to upholding religious orthodoxy. But as we mentioned above, the primary function of all states in a capitalist society is to protect and promote the economy and the making of profit.

However, as businesses are in constant competition with each other, they can only look after their own immediate financial interests – sometimes damaging the wider economy. As such, the state must sometimes step in to look after the long-term interests of the economy as a whole.

So states educate and train the future workforce of their country and build infrastructure (railways, public transport systems etc) to get us to work and transport goods easily. States sometimes protect national businesses from international competition by taxing their goods when they come into the country or expand their markets internationally through wars and diplomacy with other states. Other times they give tax breaks and subsidies to industries, or sometimes bail them out entirely if they are too important to fail.

These measures sometimes clash with the interests of individual businesses or industries. However, this doesn't change the fact that the state is acting in the interests of the economy as a whole. Indeed, it can be seen basically as a way to settle disputes among different capitalists about how to do it.

State welfare

Some states also provide many services which protect people from the worst effects of the economy. However, this has rarely, if ever, been the result of generosity from politicians but of pressure from below.

So for instance, after World War II, the UK saw the construction of the welfare state, providing healthcare, housing etc to those that needed it. However, this was because of fear amongst politicians that the end of the war would see the same revolutionary upheaval as after World War I with events like the Russian and German revolutions, the Biennio Rosso in Italy, the British army mutinies etc.

This fear was justified. Towards the end of the war, unrest amongst the working classes of the warring nations grew. Homeless returning soldiers took over empty houses while strikes and riots spread. Tory MP Quintin Hogg summed up the mood amongst politicians in 1943, saying “if we don't give them reforms, they will give us revolution.”

This does not mean reforms are 'counter-revolutionary'. It just means that the state is not the engine for reform; we, the working class – and more specifically, our struggles – are.

When our struggles get to a point where they cannot be ignored or repressed anymore, the state steps in to grant reforms. We then end up spending the next 100 years hearing people go on about what a 'great reformer' so-and-so was, even though it was our struggles which forced those reforms onto them.

When as a class we are organised and militant, social reforms are passed. But as militancy is repressed or fades away, our gains are chipped away at. Public services are cut and sold off bit-by-bit, welfare benefits are reduced, fees for services are introduced or increased and wages are cut.

As such, the amount of welfare and public service provision to the working class in a society basically marks the balance of power between bosses and workers. For example, the French working class has a higher level of organisation and militancy than the American working class. As a result, French workers also generally have better conditions at work, a shorter working week, earlier retirement and better social services (i.e. healthcare, education etc) -regardless of whether there is a right or left wing government in power.

A workers' state?

For decades, in addition to the struggle in workplaces and the streets, many workers have tried to improve their conditions through the state.

The precise methods have differed depending on location and historical context but primarily have taken two main forms: setting up or supporting political parties which run for election and are supposed to act in workers' interests, or more radically having the party seize political power and set up a workers' government through revolution. We will briefly examine two representative examples which demonstrate the futility of these tactics.

The Labour Party

The Labour Party in the UK was created by the trade unions in 1906. It soon adopted the stated aim of creating a socialist society.

However, faced with the realities of being in Parliament, and therefore the dependence on a healthy capitalist economy they quickly abandoned their principles and consistently supported anti-working class policies both in opposition and later in government .

From supporting the imperialist slaughter of World War I, to murdering workers abroad to maintain the British Empire, to slashing workers' wages to sending troops against striking dockers.

When the working class was on the offensive, Labour granted some reforms, as did the other parties. But, just like the other parties, when the working class retreated they eroded the reforms and attacked living standards. For example just a few years after the introduction of the free National Health Service Labour introduced prescription charges, then charges for glasses and false teeth.

As outlined, this was not because Labour Party members or officials were necessarily bad people but because at the end of the day they were politicians whose principle task was to keep the UK economy competitive in the global market.

The Bolsheviks

In Russia in 1917, when workers and peasants rose up and took over the factories and the land, the Bolsheviks argued for the setting up of a "revolutionary" workers' state. However, this state could not shake off its primary functions: as a violent defence of an elite, and attempting to develop and expand the economy to maintain itself.

The so-called "workers' state" turned against the working class: one-man management of factories was reinstated, strikes were outlawed and work became enforced at gunpoint. The state even liquidated those in its own quarters who disagreed with its new turn. Not long after the revolution, many of the original Bolsheviks had been executed by the government institutions they helped set up.

Against the state

This doesn't mean that our problems would be solved if the state disappeared tomorrow. It does mean, though, that the state is not detached from the basic conflict at the heart of capitalist society: that between employers and employees. Indeed, it is part of it and firmly on the side of employers.

Whenever workers have fought for improvements in our conditions, we have come into conflict not just with our bosses but also the state, who have used the police, the courts, the prisons and sometimes even the military to keep things as they were.

And where workers have attempted to use the state, or even take it over to further our interests, they have failed - because the very nature of the state is inherently opposed to the working class. They only succeeded in legitimising and strengthening the state which later turned against them.

It is our collective power and willingness to disrupt the economy that gives us the possibility of changing society. When we force the state to grant reforms we don't just win better conditions. Our actions point to a new society, based on a different set of principles. A society where our lives are more important than their 'economic growth'. A new type of society where there isn't a minority with wealth that need to be protected from those without; that is, a society where the state is unnecessary.

The state needs the economy to survive and so will always back those who control it. But the economy and the state are based on the work we do every day, and that gives us the power to disrupt them and eventually do away with them both.

More information

Private property, exclusion and the state -Junge Linke - Brief article examining the role the state plays in capitalist society.

The state: Its historical role - Peter Kropotkin - A classic anarchist text examining the state's role in society.

The state in capitalist society - Ralph Miliband - Excellent book analysing the nature of the state and how it cannot be used in workers' interests (not online unfortunately).

Capital and the state - Gilles Dauvé - More detailed libertarian communist analysis of the state.

Marxism, freedom and the state - Mikhail Bakunin - A collection of writings of the Russian anarchist with comments on the state which were sadly proved accurate with the experiences of state socialist revolutions.

The Bolsheviks and workers' control -Solidarity - A detailed examination of the anti-working class policies of the Bolsheviks in the earliest days of the Russian revolution.

Labouring in vain -Subversion - A critical history of the Labour Party from a working-class perspective.

1 note

·

View note

Text

Imported Marble,Imported Marble In India,Imported Marble In Kishangarh

IMPORTED MARBLE, IMPORTED MARBLE IN INDIA, IMPORTED MARBLE IN KISHANGARH BY BHANDARI MARBLE GROUP INDIA RAJASTHAN KISHANGARH

BHANDARI MARBLE GROUP

Website

Google Map

Face book

Instagram

Twitter

Tumbler

Pinterest

Blogger

WordPress

LinkedIn

Google

Bhandari Marble Group is the best Marble manufacturer supplier In India which Provides marble for the Residential and Commercial home, villa, hotel, projects at the best price around the world. Bhandari Marble Group has an exclusive range of marble that is the 2nd best in the world and affordable for installation purposes.

For building a house the entire big Industrialist, Architects, Interior designers, Builders Marble slabs, and marble Tiles are a perfect choice for home villa, hotels, offices, and projects. The colorful and white marble adds elegance and creates tranquility in the atmosphere. Italian marble is also used for flooring elevation and decoration.

Marble is widely used for floorings, wall claddings, borders and designs, handicraft items, and many more. White Marble is a multi-purpose product and therefore, it can be placed in bedrooms, dining halls, kitchens, lobby’s parking, storerooms, religious places, and many more.

This is one of the best features of the Bhandari Marble Group in India. Marble is a natural product that comes in beautiful designs and figures. Due to its extraordinary glaze and shine, people prefer it for both residential as well as for commercial projects. Marble is easy to fit and adds tremendous beauty to your interior. Bhandari Marble Group merely is an eye-catching product that comes in more than 20 variations.

Marble slabs of white colors are considered as valuable options for flooring material due to their gorgeousness and beauty. If you choose white marble for your home or any commercial space, you can select imported marble as flooring options. White Marbles in India are extremely popular in the market because of their excellent finish, pure white color, and smooth texture.

BHANDARI MARBLE GROUP INDIA RAJASTHAN KISHANGARH

Continue in many of today’s marble tile patterns: Check out our Studio Mosaic Collection, a truly irresistible uniquely designed geometric Water Jet patterns ready to wow your home.

More intricate designs use smaller black and white stone tiles, just like the ancient Greeks: Our Skyline Polished Collection represents a variety of shades from milky snows to cool silvers. With a backdrop of stream-lined tiles or polished mosaics, this collection has the ability to transform any space from bland to electric! Shades of white, black, and gray are often used to add dimension to a pattern.

In a trendy update to classic black and white checkerboard, adding a gray marble square creates a plaid design. We love the way it resembles a buffalo check fabric – try our new Chester Plaid Mosaic Collection in a Farmhouse bathroom, French Country kitchen, or as stunning floors in an entry

Marble Slabs & Marble Tiles

Marble Slabs are the most challenging shape of marble. Best marble slabs come in smaller sizes and shapes. In order to get the best marble slab for marble countertops, you have to look for a slab that has good color distribution, free of cracks, and has a good contrast between the background and veins. A typical marble slab is 5 ft by 3 ft and you can easily get two pieces of countertops from it. The most popular surface is the polished surface. However, honed marble slabs are preferred to make wear and tear less visible. Honing marble slabs is usually done by skilled marble finishers or marble factories.

High-quality Marble is a must

We recommend all marble floors installation. There are different types that bring out all the colors and veins in marble to the surface. One can also achieve what is called a book match veins by polishing the opposite sides of alternating slabs & tiles to give a dramatic look.

Marble is imported from various places around the world, including

Portugal, China, Greece, Spain, Turkey, Italy, and the Vietnam Marble companies go to these places to find marble as enormous rocks in its natural state. Then, the marble is cut into slabs or smaller pieces lin our factory in Kishangarh to be used in construction or in art.

Imported Marble slabs & tile also have a health benefit the marble is a natural stone and can actually keep away microscopic particles and germs if it is cleaned properly. Cons of marble tile: Marble, like many other stone tiles, has very high maintenance requirements.

How to start imported marble business in Kishangarh

Now, these days Kishangarh become the most popular Marble market in the World, We can say about Kishangarh the Marble city.

Top Imported Marble Flooring in India

BHANDARI MARBLE GROUP INDIA RAJASTHAN KISHANGARH best-imported marble, Granite & Natural stone Manufacturers a renowned marble supplier as it offers a vast array of Italian/Imported Marble and Indian marbles for various uses.

Bottochino Classic

The marble Bottochino has a natural beige color with unique brown veins.

Grey William

Grey William is marble with full grey & whitish veins, which is imported from Italy and Turkey.

Royal Diana

Royal Diana is beige color marble with thin & thick brown veins pattern.

Imported marble in Kishangarh

Marble, Italian Marble, Sandstone, Granite, and Other Imported Marble. Bhandari Marble Group is well known for its best quality Imported Italian marble. We deliver our clients high-quality services meant for natural stones like marble, limestone, travertine, and granite.

Marble – the symbol of everlasting luxury and eternal shine. Imported Marble is the stone that comes right from the mighty arms of nature, beautiful and raw, and when this flawless wonder meets our world-class techniques and machinery, magic happens. We create marble slabs that will leave you in awe. When it comes to this royal stone, we have mastered it all. Be it sourcing, mining, polishing, or packing, if it’s about imported marble. Dating back 1631, for more than half a century now We have been taking care of your flooring needs in style. And our experience shows in every slab we make.

We aim at offering our customers a complete marble experience. Explore the marble city of India – Kishangarh, the place where marbles that adorn the royal palaces of Rajasthan came from. Experience the complete royal marble experience and see us perfecting your marbles right from the scratch at our factory in Kishangarh. Visit our factory outlet and see, touch, and feel the marbles before choosing your perfect one.

We believe that marble signifies royalty and style, each slab tells a unique story, each color has stood the test of time and tide. And that’s what makes this magnificent stone so intricately beautiful. We make sure we do justice to this awe of nature by treating each marble block to a series of treatments that improve quality, strength, shine, and smoothness.

We aim at providing our customers with flooring that not only looks timeless but feels amazing too. It is the perfect regal touch in your urban home and we understand how each space is different. Choose from our wide range of Indian, Italian, and Turkish marbles in endless varieties of colors and patterns to suit your home or office space.

We believe in delivering quality to our customers. We aim at changing the flooring experience in India and are constantly working towards bettering our services. We make sure that each slab that leaves our factory at Kishangarh has been polished and treated to perfection, so that when it adorns your home it’s not only beautiful but everlasting.

Choose ever shine for a personalized experience catered to your needs. We believe in customer satisfaction above everything else, your wish is our command. Leave it all to us, whatever you want we will deliver. So come, have a complete royal marble experience with us.

Imported Marbles – Italian Imported Marble Manufacturer

Imported Marble, Red Imported Marble, Creamy Imported Marble, White Imported Marble. Top Italian Marble Company in India, Delhi, Mumbai, Bangalore, Kolkata, Jaipur, Kishangarh, Pune, Hyderabad, Vishakhapatnam, Patna, Raipur, Navy Mumbai, Ludhiana, Jammu, Amritsar, Jalandhar, Pathankot, Chandigarh, Hisar, Panipat, Sonipat, Jodhpur, Ajmer, Udaipur, Gurgaon

New Delhi, Noida, Greater Noida, Meerut, Kanpur, Agra, Moradabad, Aligarh, Indore, Ujjain, Bhopal, Jabalpur, Surat, Ahmadabad, Rajkot, Silvasa, Nagpur, Mysore, Hubli, Belgium, Goa, Pondicherry, Chennai, Madurai, Coimbatore, Trichy, Selam, Erode, Tripura, Namakwa, Kahjhikode, Trivandrum, Chichi, Nagarkoil, Bhuwneswar, Katak, Puri, Hawara, Siliguri, Jalpaiguri, Gohati, Bhutan, Kathmandu, Virat Nagar, Sikkim, Sikandrabad, Vijayawada, Ranchi, Etc.

Imported Marble in Kishangarh

Supplier Manufacturer Pure White Imported Italian marble Makrana Kishangarh Statuario Imported Dyna Italian, Bottochino Marble Price is top leading Italian marble dealers in India provide exclusive imported black and white Italian marble.

Quality/Quantity

Experience more than 500 varieties, the 365-degree finish of Marble and Stone. Pan India and abroad Shipment. Best imported quality. Over 387 years of experience. Types: Imported Italian Marbles, Imported Slab.

Imported Marble Company, Imported Granite & Marble Manufacturers and Suppliers

Imported marble from Italy, Turkey, and Spain, etc. Creating beauty that endures. Welcome to the Kishangarh Processing Unit. We deal in the best quality marble including Italian marble, Imported Kishangarh marble, Imported sandstone, imported granite, Statuario marble at very best prices in India.

Get Italian marble in Kishangarh at our store. We are the best marble dealers, manufactures, and exporters in Kishangarh and known for high quality imported marble.

Italian Marble by Bhandari Marble Group

Italian marble is considered to be superior by many due to its purity, durability, and beautiful white color. Another reason that Italian marble is thought to be superior comes simply from the rich stone working heritage of Italy. They were the first to streamline and perfect quarrying methods still used today.

Italian marble is a good option for flooring. You should make a choice depending on your budget and the end purpose. Indian marble is more pocket friendly, than Italian marble in the short run and long run as well. But if you want a class appeal for your house, then Italian marble is the only option. Some of our most popular Italian marble in-store are Calacatta, Statuario, and Carrara marble. These stones are ideal for indoor applications and are commonly used as kitchen benchtops, splashbacks, and bathroom vanities.

Italian Marble Floor, Wall, and Kitchen Design

Italian Marble gives a rich appearance to the house floor, walls, Kitchen, rooms, and bathroom with its a beautiful color, special cluster, and strains. These marble stones are really very good. The most famous type of Italian marble is Statuario, Perlato, Dyna, and beige marble.

Most people think along the lines of Well, it is still marble, right? The common perception is that Italian marble is more expensive simply because it is a prestige item. The reality is that Italian marble isn’t expensive just because it is a luxury item; it is actually a luxury item because of its premium quality.

Competitive rates and high quality

Experience more than 500 varieties and colors of Marble and Stone. Enquire Now. Best imported quality. Over 387+ years at Best Price in India –

Find here the online price details of Italian Marble. Get info of type and price, manufacturers, exporters

About the Author

Hi, I am D.C. Bhandari, chairman of Bhandari Marble Group living in India, Rajasthan, and Kishangarh. I love seeing the new and creative ways people use our Marble, Granite, and Natural Stone. Our customers are so creative. My favorite design style preppy traditional mix with modern especially pieces that can be found at a vintage or antique stone. I like to invent travel, search, and experiment with natural stone products. For more posts visit our website.

Add by expert and exporter of marble granite and natural stone.

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2019/10/u-s-unemployment-rate-hits-3-5-job-growth-moderate

U.S. unemployment rate hits 3.5%; job growth moderate

Your ads will be inserted here by

Easy Ads.

Please go to the plugin admin page to set up your ad code.

WASHINGTON, (Reuters) – The U.S. unemployment rate dropped to approach a 50-year low of 3.5% in September, with job growth increasing moderately, suggesting the slowing economy could avoid a recession for now despite trade tensions that are hammering manufacturing.

The Labor Department’s closely watched monthly employment report on Friday, however, contained reminders that the risks to the longest profitable expansion on record remained tilted to the downside. Wage growth stagnated & manufacturing payrolls declined for the first time in six months. The retail & utilities sectors in addition continued to shed jobs.

The report followed a string of weak profitable reports, including a plunge in manufacturing activity to more than a 10-year low in September & a sharp slowdown in services industry growth to levels final seen in 2016, that heightened fears the economy was flirting with a recession.

“The unemployment rate generally rises ahead of a recession, so a fresh decline pushes out the timeline for any potential recession into late 2020 at the earliest,” said Josh Wright, chief economist at iCIMS in New York.

The two-tenths of a percentage point drop in the unemployment rate from 3.7% in August pushed it to its lowest level since December 1969. The jobless rate, which had been stuck at 3.7% for three straight months, declined even as 117,000 people entered the labor force final month.

Nonfarm payrolls increased by 136,000 jobs final month, the government’s survey of establishments showed. The economy created 45,000 more jobs in July & August than previously estimated. Economists polled by Reuters had forecast payrolls would increase by 145,000 jobs in September.

September’s job gains were below the monthly average of 161,000 this year, yet still above the roughly 100,000 needed each month to keep up with growth in the working-age population. The smaller household survey from which the unemployment rate is derived showed a jump of 391,000 in employment in September.

With signs that the Trump administration’s 15-month trade war with China is spilling over to the broader economy, continued labor market strength is a critical buffer against an profitable downturn. The trade war has eroded commerce confidence, sinking investment & manufacturing.

There is in addition political uncertainty in Washington after the Democratic-controlled U.S. House of Representatives launched an impeachment inquiry against President Donald Trump over accusations he pressed Ukrainian President Volodymyr Zelenskiy to investigate former U.S. Vice President Joe Biden, a main candidate for the 2020 Democratic presidential nomination.

These factors, together with benign wage inflation, are likely to immediate the Federal Reserve to cut interest rates at least one more time this year, economists said. The U.S. central bank cut rates final month after reducing borrowing costs in July for the first time since 2008, to keep the profitable expansion, now in its 11th year, on track.

Fed Chair Jerome Powell reiterated on Friday that the economy was “in a satisfactory place,” adding that “our job is to keep it there as long as possible.”

The dollar .DXY was little changed against a basket of currencies. Prices of U.S. Treasuries rose marginally. Stocks on Wall Street were trading higher.

STRONG GOVERNMENT HIRING

“We continue to expect the Fed to cut its target interest rate after this month,” said Michael Feroli, an economist at JPMorgan in New York. “We believe it would have taken a much stronger number to convince Fed leadership that they have already taken out enough insurance against downside risks.”

Economic growth estimates for the third quarter range from as low as a 1.3% annualized rate to as high as a 1.9% pace. The economy grew at a 2.0% pace in the moment quarter, slowing from a 3.1% rate in the January-March period.

Your ads will be inserted here by

Easy Ads.

Please go to the plugin admin page to set up your ad code.

Slower growth was reinforced by a report from the Commerce Department on Friday that showed the U.S. trade deficit widened 1.6% to $54.9 billion in August.

A broader degree of unemployment, which includes people who want to work yet have given up searching & those working part-time because they cannot find full-time employment, declined to 6.9% final month, the lowest level since December 2000, from 7.2% in August.

Despite the tight labor market, average hourly earnings were unchanged final month after advancing 0.4% in August. That lowered the annual increase in wages to 2.9% from 3.2% in August. The average workweek was unchanged at 34.4 hours.

Some economists believe wage growth is stalling because companies are hiring inexperienced workers in the face of labor shortages. Others blame the slowdown on ebbing demand for workers.

“With demand for labor softening & many companies contending with higher input costs as the trade war lingers & broadens, we do not expect to see any meaningful strengthening in wage growth in the coming months,” said Sarah House, a senior economist at Wells Fargo Securities in Charlotte, North Carolina.

Hiring is slowing across all sectors, with the exception of government, which is being boosted by state & local government recruitment. Private payrolls increased by 114,000 jobs in September after rising by 122,000 in August.

The three-month average gain in private employment fell to 119,000, the smallest since July 2012, from 135,000 in August.

Manufacturing shed 2,000 jobs final month, the first decline in factory payrolls since March, after a gain of 2,000 jobs in August. Manufacturing has ironically borne the brunt of the Trump administration’s trade war, which the White House has argued is intended to boost the sector.

Last month’s decline in manufacturing payrolls was led by the automotive sector, which lost 4,100 jobs. Further losses are likely whether a strike by General Motors (GM.N) workers continues.

FILE PHOTO: A “Now Hiring” sign sits in the window of Tatte Bakery & Cafe in Cambridge, Massachusetts, U.S., February 11, 2019. REUTERS/Brian Snyder/File Photo/File Photo/File Photo

Construction employment increased by 7,000 jobs after rising by 4,000 in August. Retail payrolls fell by 11,400 jobs, marking an eighth straight monthly drop.

Government employment increased by 22,000 jobs in September after surging by 46,000 in August. Hiring was boosted by state & local governments. Only 1,000 workers were hired final month for the 2020 Census. Government payrolls have increased by 147,000 over the year, driven by local governments.

Reporting by Lucia Mutikani; Editing by Sandra Maler & Paul Simao

Our Standards:The Thomson Reuters Trust Principles.

Your ads will be inserted here by

Easy Ads.

Please go to the plugin admin page to set up your ad code.

#affiiate marketing#article marketing#business online#businessNews#internet marketing#make money online#mobile marketing#video marketing#web marketing

0 notes

Text

Germany flies into ‘perfect storm’ as economy heads towards recession — live updates